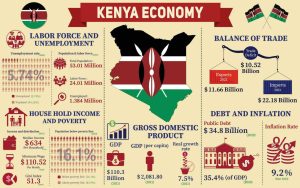

In the pursuit of economic growth and development, African countries such as Kenya have increasingly recognized the pivotal role that foreign investment plays. However, attracting and retaining foreign investors requires a conducive environment and robust strategies that instill confidence. Here are some ways in which African developing countries, including Kenya, can improve investor confidence and bolster their economies:

1. Strengthening Political Stability: Political stability is a cornerstone for attracting foreign investment. African countries must prioritize transparent governance, uphold the rule of law, and ensure peaceful transitions of power. By fostering a stable political environment, countries like Kenya can mitigate risks for investors and create a conducive atmosphere for long-term investments.

2. Enhancing Regulatory Frameworks: Streamlining and simplifying regulatory processes is essential to attract foreign investors. African countries should work towards creating investor-friendly policies, reducing bureaucratic red tape, and ensuring consistency in regulations. Clear and predictable regulatory frameworks instill confidence in investors, demonstrating a commitment to facilitating business operations.

3. Investing in Infrastructure: Infrastructure development is vital for economic growth and attracting foreign investment. African countries like Kenya must prioritize investments in transportation, energy, telecommunications, and logistics infrastructure. Improving infrastructure not only enhances connectivity but also reduces operating costs for businesses, making the country more attractive to investors.

4. Promoting Trade and Investment Agreements: Participation in regional and international trade agreements can significantly enhance foreign investor confidence. By fostering an open and liberalized trade environment, countries like Kenya can expand market access for investors and facilitate cross-border trade. Additionally, bilateral investment treaties provide assurances to investors, protecting their interests and investments.

5. Strengthening Institutions and Governance: Robust institutions and effective governance mechanisms are critical for building investor confidence. African countries need to combat corruption, strengthen property rights, and enhance judicial systems to ensure the rule of law. Transparent and accountable institutions instill trust in investors, assuring them of fair treatment and protection of their investments.

6. Fostering Human Capital Development: Investing in education, skills training, and workforce development is essential for attracting foreign investment. African countries should prioritize initiatives that enhance the quality and productivity of the workforce. A skilled and educated workforce not only increases the attractiveness of the country for investors but also drives innovation and economic diversification.

7. Showcasing Success Stories and Investment Opportunities: Promoting success stories and highlighting investment opportunities can attract foreign investors’ attention. African countries like Kenya should actively market their investment potential, showcasing successful projects and demonstrating the benefits of investing in key sectors such as technology, agriculture, and renewable energy. Effective marketing campaigns can help raise awareness and generate investor interest.

In conclusion, African developing countries, including Kenya, have immense potential to attract foreign investment and drive economic growth. By prioritizing political stability, enhancing regulatory frameworks, investing in infrastructure and human capital, and fostering transparent governance, these countries can significantly improve investor confidence and unlock their economic potential. With concerted efforts and strategic initiatives, Africa can become a hub for foreign investment, driving sustainable development and prosperity for its people.